When it comes to corruption in Delaware’s Chancery Court,

the public must now assume: where there is smoke, there is fire!

According to a recent complaint in Federal Court,

TransPerfect’s #1 competitor was invited to participate in the

“auction” — but instead the competitor seems to have used the

Chancery’s “airtight” auction process as a massive platform to steal

TransPerfect’s trade secrets. So much for the public expectation of Delaware’s

Chancellor Bouchard to comply with his sworn duty to protect Delaware

companies– APPARENTLY NOT!

Some conspiracies fly under the radar because they are too

complicated to garner the appropriate attention, but remember folks, these

judges, lawyers, and good old boy Delaware elitists are sophisticated actors —

it’s no coincidence that $250 million was spent on lawyers and custodial fees.

Behold the following facts:

1. HIG/Lionbridge is TransPerfect’s #1 competitor.

2. Custodian Pincus of Skadden Arps allowed HIG/Lionbridge

unfettered access to hundreds of thousands of corporate documents, including

the most guarded secrets of TransPerfect.

3. HIG/Lionbridge is a client of the Skadden law firm.

4. HIG/Lionbridge is a client of Credit Suisse (but abruptly

switched sides to “represent” TransPerfect for Pincus).

5. HIG had a loan with Credit Suisse, so IF Credit Suisse

could have swung the auction results to HIG/Lionbridge, it would have helped

Credit Suisse. They call this a “conflict of interest.”

6. The “conflict of interest” would normally have

called for Credit Suisse to resign, but something made them feel protected

enough not to resign.

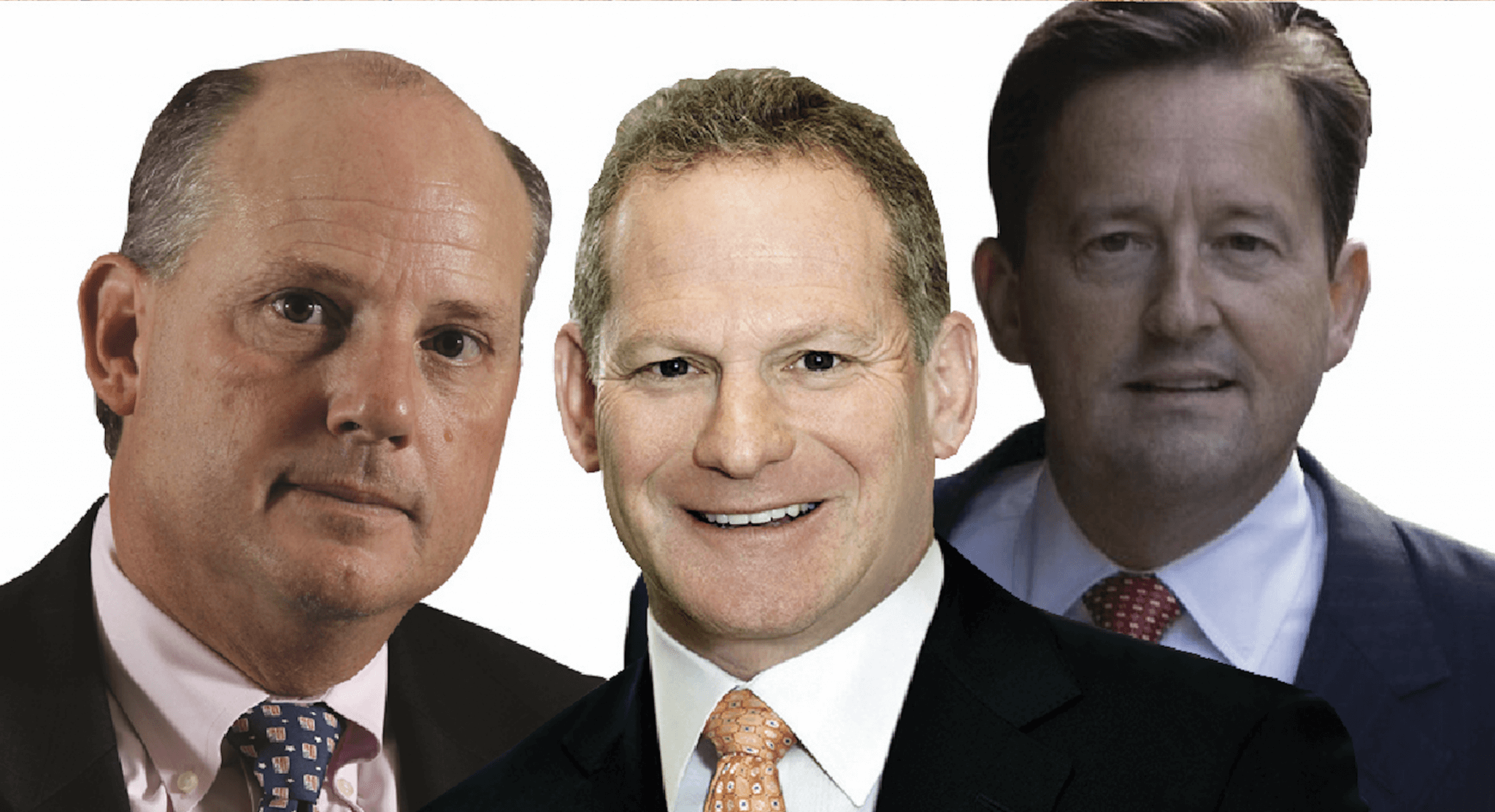

7. Skadden Arps alumni include none other than: Chancellor

Andre Bouchard, Custodian Robert Pincus, and Chief Justice Leo Strine

(Bouchard’s former intern).

The above information is gleaned from my two years of

research in following all the details of this case. If you think I may have the

facts wrong, then please read the following link below: publicly available in a

New York Supreme Court filing:

https://iapps.courts.state.ny.us/nyscef/ViewDocument?docIndex=qvdJYpXr7_PLUS_7tMrkT9_PLUS_oWMg==

Is all this just coincidence? But folks, we must ask

ourselves is the $250 million dollars spent and distributed among Bouchard’s

cronies and former business partners (Skadden Arps Law firm) a legitimate

situation?

Credit Suisse is also more likely to be paid back on their

HIG/Lionbridge debt, if HIG/Lionbridge got a leg up in the competitive market

for translation by getting its hands on all of TransPerfect’s trade secrets,

including detailed client information, and including decision-makers and price

lists.

Perhaps the alleged trade secret theft happened with

HIG/Lionbridge acting on their own, but given all these connections, perhaps

not. You decide! Please read the article

below and send me your feedback. Your comments are welcome and appreciated.

TransPerfect Hits Rival Lionbridge With $300M Secrets Suit

By Pete Brush

Law360, New York (April 15, 2019, 5:47 PM EDT) —

TransPerfect Global has sued rival translation company Lionbridge Technologies

and private equity firm H.I.G. Capital for $300 million, claiming in Manhattan

federal court that they exploited a court-ordered sale of TransPerfect equity

to lift trade secrets.

The Thursday lawsuit, pending before U.S. District Judge

Denise L. Cote, claims that a unit of Miami-based H.I.G., H.I.G. Middle Market

LLC, engaged in “fake bidding” during the $770 million sale of a 50%

stake in New York-based TransPerfect to help Massachusetts-headquartered

Lionbridge gain an unfair advantage.

“For H.I.G., losing the auction was not a defeat because it was able to accomplish its refocused goal to gain an unfair competitive advantage over [TransPerfect],” the suit says.

H.I.G. and Lionbridge had discussed a go-private deal in 2016 that could have seen the private equity firm take control of both companies and permitted Lionbridge to “solidify its position as the dominant translations services provider worldwide,” the suit says.

H.I.G. completed its acquisition of Lionbridge in early 2017. But, according to the suit, even though TransPerfect co-founder Philip R. Shawe later that year won the auction for the TransPerfect stake, H.I.G. and Lionbridge still profited by gaining access to secrets that were pilfered from what should have been an airtight process mandated by a Delaware business court.

Credit Suisse, which handled the auction and is not a party to the lawsuit, “failed to take meaningful steps to protect the company’s confidential information, and defendants were permitted to freely interview

[TransPerfect’s] management and downloaded [its] top client lists, pricing information, commission schedules, employee files, and sales strategies,” the suit says. The suit adds that Credit Suisse owns Lionbridge debt and was “incentivized” to help H.I.G. shore up that debt.

H.I.G.’s conduct also delayed completion of the sale to Shawe and disrupted the plaintiff’s business, the suit says.

The sale of TransPerfect assets stemmed from a dispute between Shawe and company co-founder Elizabeth Elting over how to run the company that dates to 2014. H.I.G. improperly contacted Elting during the asset auction and assisted her in objecting to the sale to Shawe, the lawsuit says.

Lionbridge continues to use TransPerfect’s proprietary information to compete unfairly, according to the suit. TransPerfect seeks injunctive relief as well as damages, including punitive damages, in excess of $300 million.

Requests for comment from Lionbridge and H.I.G. were not returned. A lawyer representing TransPerfect declined comment. Credit Suisse declined comment.

TransPerfect is represented by Andrew Goodman of Garvey Schubert Barer and Martin Russo and Sarah Khurana of Kruzhkov Russo PLLC.

The case is TransPerfect v. Lionbridge et al., case number 1:19-cv-03283, in the U.S. District Court for the Southern District of New York.

–Editing by Amy Rowe.