OPINION

Dear friends,

I would like to say that winning in Delaware Courts has something to do with the truth, the merits, justice, or the law. In my view, It does not, so I can’t say it!

I wrote some rules to guide future litigants:

Rule 1) Perhaps be best friends and golfing buddies with the Judge, like Kevin Shannon?

Rule 2) Be rich, be elite, and be country-club connected to the billionaire-boys club, perhaps like the Chancery Court Judges?

Rule 3) Re-Read Rules 1) and 2)

See this Reuters article below and smell what I consider the stench of the “Delaware Way” corruption, as attorney Kevin Shannon notches yet another remarkable against-all-odds win.

God help us in Delaware if this form of justice continues. The only way this can ever be fixed is to change Delaware’s political leadership which I fervently advocate.

Let me know your thoughts on this one, folks!

Respectfully Yours,

JUDSON Bennett-Coastal Network

COASTALNETWORK.com

Delaware court axes Baker Hughes shareholder claims over GE merger

By Maria Chutchian

(Reuters) – A Delaware court on Tuesday threw out most of the claims brought by Baker Hughes Co shareholders asserting they were not given complete financial information about the oilfield service provider’s 2017 merger with General Electric’s oil and gas segment.

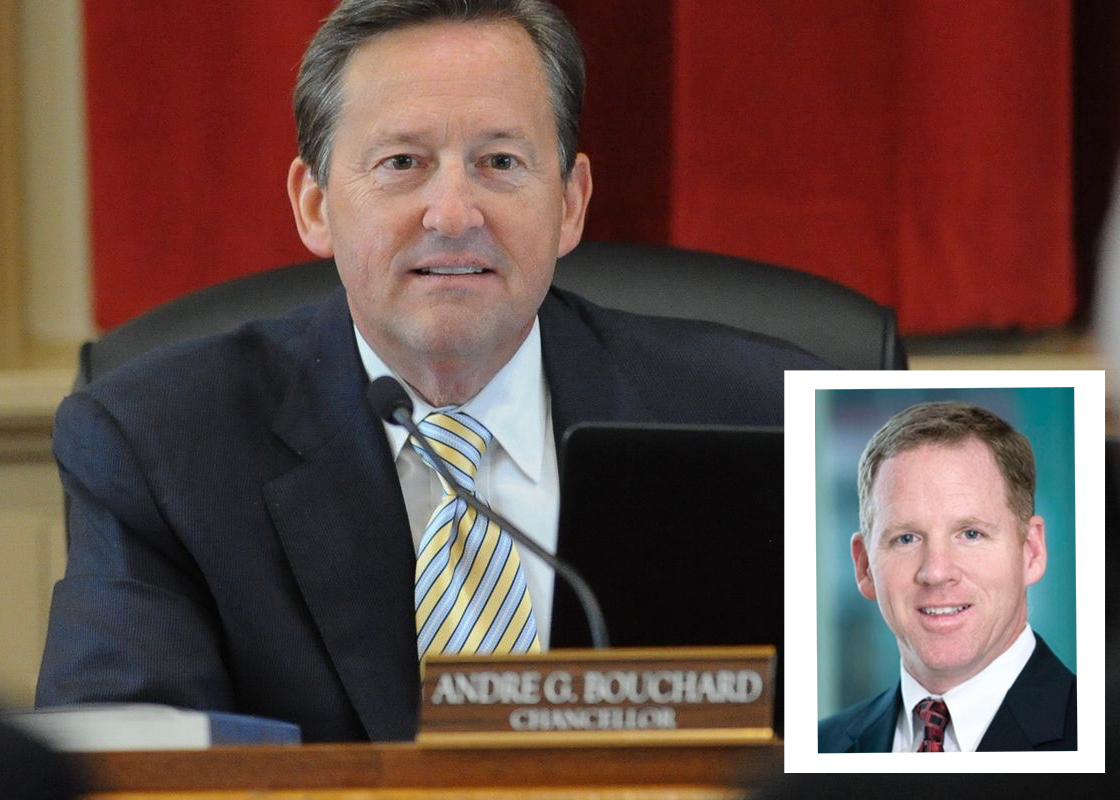

In a 55-page decision, Chancellor Andre Bouchard of the Delaware Court of Chancery dismissed claims against GE, former Baker Hughes CEO Martin Craighead and the company’s former CFO, Kimberly Ross, accusing them of misleading shareholders about the $23 billion merger. He did, however, allow a claim that Craighead breached “disclosure duties” to stand.

Lawyers for the shareholders, Frank Schirripa of Hach Rose Schirripa & Cheverie and Jeroen van Kwawegen of Bernstein Litowitz Berger & Grossmann, did not immediately respond to a request for comment.

The shareholders had argued they should have received the unaudited financials that the board relied on in initially signing off on the deal as well as the audited financials that were later disclosed so they could compare the two before voting on the deal. The agreement included a provision whereby Baker Hughes could terminate the merger and receive a fee if it discovered material differences between the unaudited and audited financials.

Bouchard wrote that the shareholders failed to support their claim that GE, by not ensuring that its unaudited financials were included in a proxy statement Baker Hughes distributed to shareholders, aided the board’s failure to disclose key information to the shareholders. The shareholders did not offer sufficient allegations that GE knowingly or otherwise participated in the board’s decision not to disclose the unaudited financials, he concluded.

“Plaintiffs’ primary contention is that General Electric aided and abetted the Baker Hughes directors in breaching their duty of care by creating an informational vacuum that induced the board to enter a bad deal based on GE O&G’s unaudited financial statements,” Bouchard wrote. “This claim is not reasonably conceivable.”

The shareholders filed two suits in 2019, which were eventually consolidated. In addition to their claims against GE, they accused the Baker Hughes board of breaching its fiduciary duty by entering the deal based on unaudited financial statements from GE. They later dropped those claims and instead focused on those against GE and the company’s CEO and CFO.

In Tuesday’s decision, Bouchard found that the plaintiffs sufficiently alleged that the lack of unaudited financials to compare with audited financials in a proxy statement was a “material omission.”

However, he deemed the allegations that Ross acted in bad faith or was grossly negligent with respect to the merger “exceedingly thin.” Bouchard did allow the same disclosure-related claim against Craighead to survive due to the shareholders’ allegation that he signed the proxy in question.

The judge dismissed a breach of fiduciary duty claim against Ross and Craighead in its entirety, noting that a 12-member board of directors approved the merger and that the complaint does not allege that the two officers concealed audited financials from the board.

“In effect, Plaintiffs’ grievance is that Craighead and Ross did not pound on the table vigorously enough to persuade twelve concededly independent and disinterested Board members to reach a different conclusion concerning the import of the Audited Financials. Plaintiffs cite no authority to support such a claim and the court is aware of none,” Bouchard wrote.

The case is In re Baker Hughes Incorporated Merger Litigation, Court of Chancery of the State of Delaware, No. 2019-0638.

For the shareholders: Ned Weinberger and Thomas Curry of Labaton Sucharow; Jeroen van Kwawegen, Edward Timlin, Alla Zayenchik and Gregory Varallo of Bernstein Litowitz Berger & Grossmann; Thomas Uebler, Joseph Christensen and Hayley Lenahan of McCollom D’Emilio Smith Uebler; and Frank Schirripa and Kurt Hunciker of Hach Rose Schirripa & Cheverie

For Craighead and Ross: Kevin Shannon, Matthew Davis, and Callan Jackson of Potter Anderson & Corroon; and Samuel Cooper and Edward Han of Paul Hastings.

For GE: Michael Kelly, Andrew Dupre and Sarah Delia of McCarter & English; and Alan Goudiss, Paula Howell Anderson and Grace Lee of Shearman & Sterling