Dear friends,

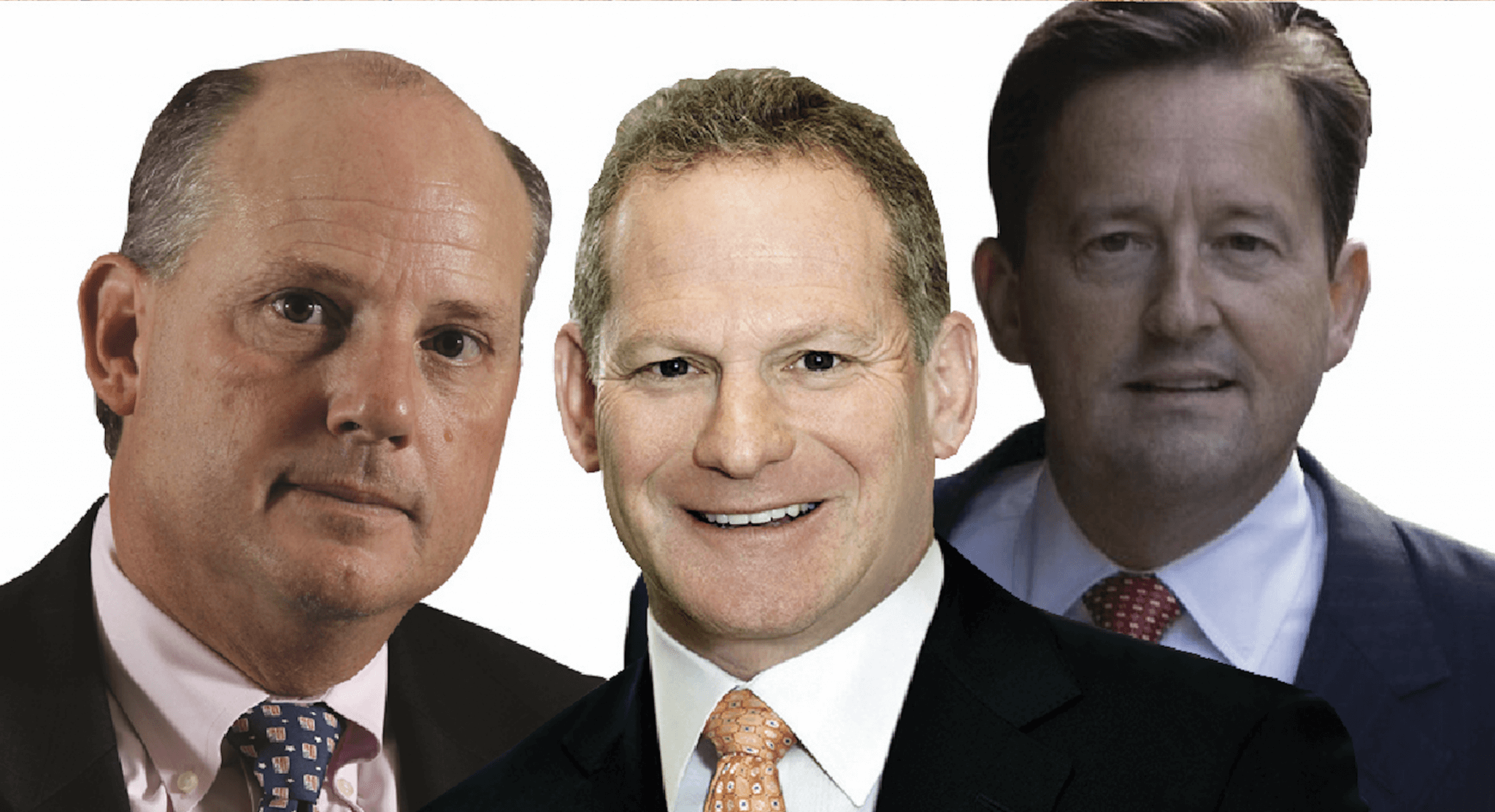

Take a look at this, folks. Skadden Arps, the law firm in Delaware, in the Jeff Montgomery Law360 story below, is accused of concealing a conflict of interest, yet again! Just like in the notorious TransPerfect case in Delaware, where you had the judge, Andre Bouchard, the appellate judge, Leo Strine, and the court-appointed custodian Robert Pincus, all of Skadden, collecting hundreds of millions of dollars from the company and continuing to send bills, years after the case closed.

Honestly, folks, it’s the biggest conflict of interest I’ve ever seen! In my view, after following this collective for years, what I consider to be corruption by Skadden and the Skadden trio of Bouchard, Stine and Pincus, is beyond comparison.

Now there’s more evidence. Aggravating! I’ve highlighted the key parts of the story below. Somehow it continues?!

Please send feedback. We need to do better than this and we are better than this!

Respectfully Yours,

[avatar user=”Judson Bennett” size=”thumbnail” align=”left” link=”https://twitter.com/Judson_Bennett” target=”_blank”]Respectfully yours. Judson Bennett[/avatar]

Acthar Claimants Hit Skadden For Mallinckrodt Ch. 11 Role

By Jeff Montgomery

Law360 (February 5, 2021, 8:42 PM EST) — Class attorneys for alleged victims of Mallinckrodt PLC’s Acthar Gel product asked a Delaware bankruptcy judge to hold a hearing on Skadden’s role in the drug company’s Chapter 11 in Delaware, pointing to allegedly undisclosed, potentially disqualifying conduct and conflicts of interest.

The late Thursday objection, which followed the same group’s bid on Feb. 1 for the retention of a trustee to direct the case, cited Skadden Arps Slate Meagher & Flom LLP’s purported failure to fully disclose in “ordinary course professional” declarations its prepetition work for Express Scripts, a Mallinckrodt co-defendant in multistate, prepetition fraud and antitrust litigation.

According to the Acthar plaintiffs’ group’s objection, the retention of Skadden and other potentially conflicted counsel left open the possibility that firms would work on Mallinckrodt’s defenses in litigation stayed by the bankruptcy. That work would potentially be covered in an estimated $6 million monthly payout for ordinary course work in the Chapter 11 case, obscuring prepetition connections while also depleting debtor assets that should be reserved for creditor claims.

“The OCP program is, at least in this case, the way it has been abused, the proverbial elephant in the room,” the objection states.

The Acthar plaintiffs’ group, which had lost an argument earlier in the case to subpoena Skadden, accused the firm in its new objection of engaging “in conduct designed to both conceal its conflicting relationships with the debtors until after this court ruled on the motion for preliminary injunction and motion to quash, as well as conceal its connections to both debtor and asserted unsecured creditor Express Scripts.”

“Plaintiffs routinely level unfounded accusations against highly reputable law firms. Courts have soundly rejected these prior attempts and we expect the same outcome here,” Skadden said in a statement late Friday.

Counsel for Mallinckrodt did not immediately respond to a request for comment.

Mallinckrodt sought Chapter 11 protection in mid-October with $5.3 billion in debt, citing threats posed by the sprawling multidistrict litigation seeking damages for victims of opioid addiction. The bankruptcy was also driven in part by the potential for $15 billion in damages tied to a range of suits involving its H.P. Acthar Gel, which is used to treat multiple sclerosis, infantile spasms and other conditions, the company said. Potential claims from governmental entities could top $2 trillion.

The Acthar suits range from government whistleblower actions alleging the underpayment of Medicaid rebates for the drug to unfair trade practice and kickback prosecutions to stockholder class claims focused on allegedly false and misleading claims about the drug and the business.

Acthar class plaintiffs who took aim at Skadden include the city of Rockford, Illinois, three unions and Acument Global Technologies, which sued individually and on behalf of third-party payors and their beneficiaries. Their attorneys accused Mallinckrodt and Express Scripts of antitrust violations in Illinois, Pennsylvania and New Jersey.

“The evidence will show and additional discovery will ferret out, that there is no doubt that Skadden represented Express Scripts in the Acthar Plaintiffs lawsuits, until the summer of 2019 when AlixPartners took over the management of the debtors’ affairs, including litigation strategy,” the objection says. “The court need only examine the dockets in each of the Acthar plaintiffs’ lawsuits to see the fact of this prior, disqualifying representation.”

The objection argues that Skadden’s retention should be denied and that it should be required to return fees already paid based on its failure to fully disclose its prepetition relationships in declarations filed with the court. Also targeted are alleged efforts to avoid a subpoena from the Acthar plaintiffs’ group seeking details on what was described as Skadden’s “dual representation” of Mallinckrodt and Express Scripts.

“Now, more than four months into the case, hindsight review is required of all relationships, prior payments, retainers, scope of work, etc., all because the debtors and certain ‘OCP’ professionals took advantage of the OCP program in ways never contemplated, instead of just following the rule of law,” the objection states.

Under Mallinckrodt’s bankruptcy road map, the court approved a plan that would channel all opioid claims to a $1.6 billion settlement trust. A separate seven-year, $260 million settlement meanwhile would end multiple False Claims Act and related suits targeting the company’s handling of Acthar reimbursements.

The Acthar plaintiffs are represented by Daniel K. Astin, Albert A. Ciardi III and Walter W. Gouldsbury III of Ciardi Ciardi & Astin; Donald E. Haviland Jr. and William H. Platt II of Haviland Hughes; Dion G. Rassias and Jillian E. Johnston of The Beasley Firm LLC; James Bartimus and Anthony DeWitt of Bartimus Frickleton Robertson Radar PC; and Peter J. Flowers and Jonathan P. Mincieli of Meyers & Flowers LLC.

Mallinckrodt and its affiliates are represented by George A. Davis, George Klidonas, Christopher Harris, Andrew Sorkin, Anupama Yerramalli, Jeffrey E. Bjork and Jason B. Gott of Latham & Watkins LLP, and Mark D. Collins, Michael J. Merchant, Amanda R. Steele, Brendan J. Schlauch and Sarah E. Silveira of Richards Layton & Finger PA.

The case is In re: Mallinckrodt PLC et al., case number 1:20-bk-12522, in the U.S. Bankruptcy Court for the District of Delaware.

–Additional reporting by Matthew Perlman and Julia Arciga. Editing by Steven Edelstone.