What a shocker, folks! Whenever I read about Bouchard’s long-time friend and country club crony, Kevin Shannon of Potter Anderson, involved in a decision in Delaware’s Chancery Court, I have to wonder: It is another win!! What are the odds??

If you wanted mathematical proof that the Chancery Court, in my educated personal opinion, is now nothing more than a corrupt parasite that leeches off the people and businesses of Delaware, my view is that you need look no further than Kevin Shannon’s win percentage?

Further, you may remember how many of the cast of cronies – who in my opinion, got rich or enriched their pals, off the backs of TransPerfect’s workers – all got super cozy with each other in the first place? They worked on Delaware’s 2nd most famous case, the Disney/Ovitz case: Shannon, Bouchard, and Kramer Levin (including Gary Navtalis himself) all worked as co-counsel against the shareholders – in fighting to allow management – to give Ovitz one of the largest executive severance payments in history. It’s just another amazing coincidence that could only happen in Delaware. It’s an outrageous disgrace in my opinion. As I see it – and it is my definite belief that these people are possible co-conspirators who met on Disney-Ovitz – I believe they’ve been working together to extract millions together in many ways ever since!

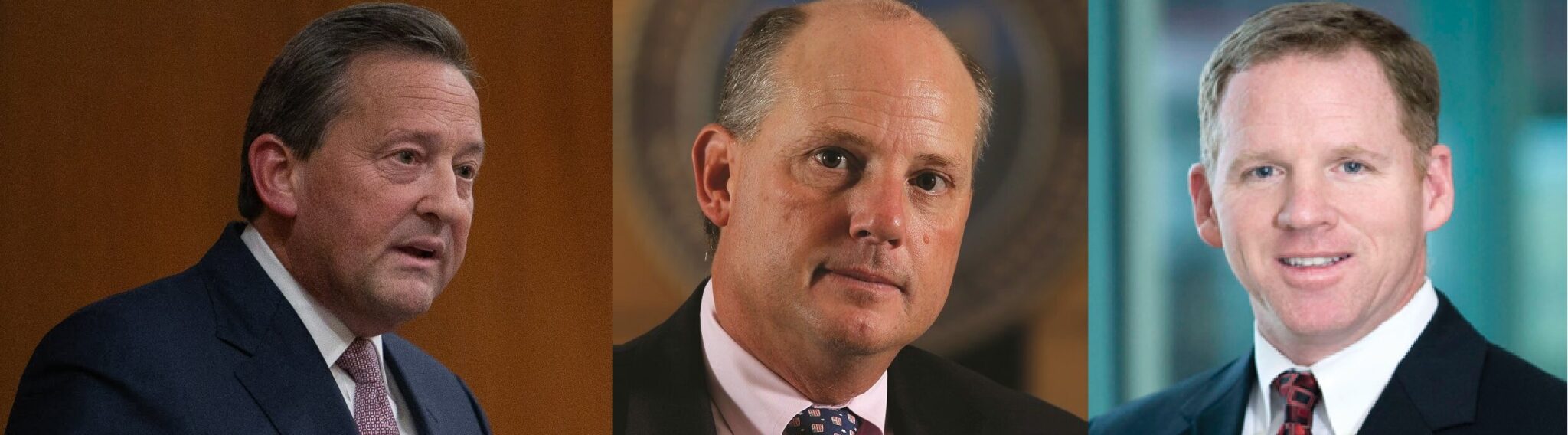

Folks, the Chancery Court in my opinion, under Bouchard has been a corrupt disgrace for over 6 years. When I think about Chancellor Bouchard, Kevin Shannon, Jennifer Voss, and Bob Pincus, no matter how much I wash, I can’t feel clean. Something is way too coincidental, subjective, and seemingly inequitable.

The verdict is still out on McCormick. Let’s pray for a better tomorrow.

Please check out the article below and send your feedback, folks. It is always appreciated!

Respectfully Yours,

Judson Bennett

Coastal Network

Chancery Nixes Dyal Capital-Owl Rock Tie-Up Injunction

By Jeff Montgomery

Law360 (April 20, 2021, 5:04 PM EDT) — Sixth Street Partners Management Co. lost a battle Tuesday to block Dyal Capital Management’s $12.5 billion merger with Owl Rock Capital, after a Delaware vice chancellor branded its preliminary injunction motion as an unsupportable bid to force an undervalued Dyal sell-back of its stake in Sixth Street.

Vice Chancellor Morgan T. Zurn, ruling after a hearing on March 24, found that Sixth Street’s suit and a similar, unsuccessful action by Golub Capital in New York “were part and parcel of a calculated effort to ‘muck up'” the Owl Rock transaction and create pressure for the buyout.

Dyal, a multifaceted holding of Neuberger Berman Group, acquired an interest in Sixth Street’s $50 billion business in 2017 through its third unit, Dyal III. In December, however, Dyal announced a planned merger with Owl Rock Capital, a credit business that Sixth Street views as a competitor and a potential beneficiary of Dyal’s access to Sixth Street’s proprietary information.

Sixth Street said in a complaint earlier this year that Dyal intended to funnel knowledge gathered from its stake in Sixth Street into the merged Dyal-Owl Rock business – to be named Blue Owl Capital Inc. – despite prohibitions in the 2017 Dyal-Sixth Street investment agreement. It sued both Dyal and Neuberger Berman.

“Sixth Street’s concerns about misuse of its confidential information in the hands of a competitor are speculative at best and cannot support a preliminary injunction,” Vice Chancellor Zurn wrote. “Since filing, nothing in the record indicates Sixth Street ever actually became concerned about its confidential information. Rather, the record further undermines Sixth Street’s purported irreparable harm.”

In a statement released Tuesday, Dyal said, “We’re pleased with this resounding victory. We look forward to completing our strategic combination and remain on track to do so in the first half of this year.”

Dyal’s five limited partnership funds manage passive minority equity in 50 private investment businesses. General partners, controlled by Neuberger, manage the LPs, with Dyal III acquiring a passive minority stake in Sixth Street for $417 million in 2017.

The deal provided Dyal with limited information rights needed to monitor its Sixth Street investment but not competitive information. Vice Chancellor Zurn said Sixth Street’s own senior executives noted the distinction while reassuring their investors about risks from the Owl Rock deal late last year, “reiterating its lack of concern on multiple occasions.”

Sixth Street’s posture changed early this year, the court said, with an assertion that the Dyal-Owl Rock merger required Sixth Street’s consent in what the court concluded was an effort to force a buyback. Although Dyal offered additional assurances, Sixth Street demanded buyback of its stake for the same $417 million price paid in 2017, despite indications as early as 2018 that Sixth Street’s value had risen to $6 billion, implying a $700 million value for Dyal’s holding.

During arguments in March, William Savitt of Wachtell Lipton Rosen & Katz LLP told the vice chancellor, “There’s an active, guerilla war campaign on behalf of Sixth Street to block this deal.” He said the injunction effort “confirms to us that what we’re talking about here is an attempt to get leverage to force a buyback at non economic terms, to create a windfall in Sixth Street’s favor.”

A Sixth Street spokesman said Tuesday, “We entered into our agreement with the understanding that Dyal would be our partner and not our competitor. We are disappointed that Dyal and Neuberger’s unreliable narrative was the basis of today’s decision, and we will consider appropriate options. Our focus always has been and continues to be providing value for our stakeholders.”

During arguments last month, Andrew Rossman of Quinn Emanuel Urquhart & Sullivan LLP, counsel for Sixth Street, said, “The bedrock principle in hundreds of years of partnership law is ‘You get to pick your partner.’ That’s what this case is about.”

Vice Chancellor Zurn found that Sixth Street’s effort “threatens the interests of a panoply of parties interested in the Dyal-Owl Rock transaction, “including Neuberger and Owl Rock investors who are in no way implicated in Sixth Street’s relationship with Dyal III.” The decision also noted that Sixth Street’s attorney also represented Golub Capital in its unsuccessful attempt earlier this month to block the deal in a New York state court.

The court rejected all of Sixth Street’s claims, including an alleged breach of a transfer restriction in the 2017 investment agreement and tortious interference with a contract.

Dyal violated none of the Sixth Street agreement’s transfer restrictions, the vice chancellor found, adding that “Sixth Street’s interpretation would have the court enjoin a transaction at any level of Dyal’s corporate pyramid, regardless of whether that entity was explicitly bound by the transfer restriction.”

“Sixth Street’s concerns about misuse of its confidential information in the hands of a competitor are speculative at best and cannot support a preliminary injunction,” the vice chancellor wrote.

Sixth Street Partners LP et al. are represented by Michael A. Barlow and Eliezer Y. Feinstein of Abrams & Bayliss LLP, and R. Brian Timmons, Andrew Rossman, Corey Worcester, Maaren Shah, David Mader and Kimberly Carson of Quinn Emanuel Urquhart & Sullivan LLP.

Dyal Capital Partners III et al. are represented by Kevin R. Shannon, Christopher N. Kelly and Daniel M. Rusk of Potter Anderson & Corroon LLP, and William Savitt, Stephen R. DiPrima, Corey J. Banks, Nathaniel D. Cullerton, Daniel H. Rosenblum and David P.T. Webb of Wachtell Lipton Rosen & Katz.

Neuberger Berman Group LLC is represented by Robert S. Saunders, Sarah Runnells Martin, Jacob J. Fedechko, Susan Saltzstein and Shaud Tavakoli of Skadden Arps Slate Meagher & Flom LLP.

The case is Sixth Street Partners Management Company LP et al. v. Dyal Capital Partners III (A) LP et al., case number 2021-0127, in the Court of Chancery of the State of Delaware.