OPINION

Dear Friends,The Chancery Court keeps sorid company with Credit Suisse, which postponed its annual report due to financial statement trouble with the U.S. Securities and Exchange Commission (SEC). This comes after Credit Suisse was found guilty in a cocaine cash laundering case!

First that, now this, folks. What unsavory company our once-proud Chancery Court keeps!

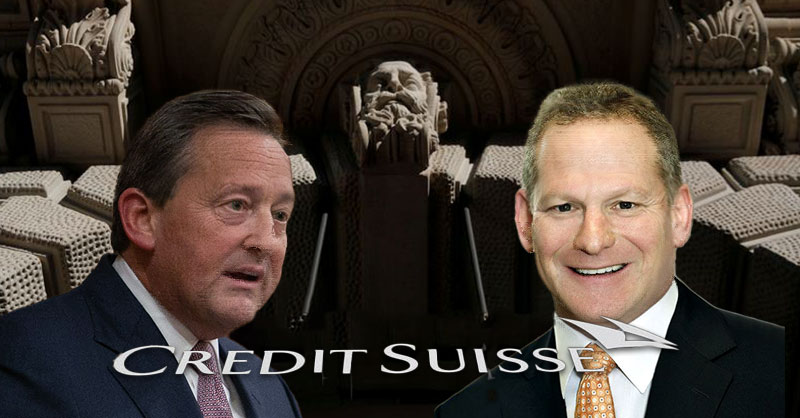

These are the people that Robert Pincus and Andre Bouchard conspired with and hired to auction off TransPerfect, as I wrote about this week.

Now clients are withdrawing billions, which is ironic because greed and a lack of humanity is exactly what got Credit Suisse into this scorching hot mess of quicksand in the first place. They are guilty and deserve this sleazy slop disaster that they’ve gotten themselves into.

This court needs a facelift and pronto, folks!

Please see the Reuters story below and send your feedback on this, folks. It’s always welcome and appreciated.

Respectfully Yours,

JUDSON Bennnett–Coastal Network

March 9, 2023

Credit Suisse delays annual report after SEC call

By Noele Illien and Oliver Hirt

ZURICH, March 9 (Reuters) – Credit Suisse has postponed publication of its annual report after a last-minute call from the United States Securities and Exchange Commission (SEC), which raised questions about its earlier financial statements.

The unusual intervention by the U.S regulator is the latest blow to Credit Suisse as it attempts to rebuild investor confidence after a series of scandals and setbacks that have sent its shares plunging and led clients to withdraw billions.

The Zurich-based bank said the SEC had called it late on Wednesday regarding “certain open SEC comments about the technical assessment of previously disclosed revisions to the consolidated cash flow statements in the years ended December 31, 2020, and 2019, as well as related controls.”

The bank had revised how it booked a series of cash flows, including share-based compensation and foreign exchange hedges.

Credit Suisse said that following the call it had decided to postpone publication of its 2022 annual report.

“Management believes it is prudent to briefly delay the publication of its accounts in order to understand more thoroughly the comments received,” it said, adding that the 2022 financial results “are not impacted”.

The SEC declined to comment on the matter, a spokesman for the organization said.

Other regulatory authorities were not involved, a person familiar with the matter said.

Swiss financial regulator Finma told Reuters that Credit Suisse had informed it of the delayed publication.

“We are in contact with the bank,” Finma said.

‘CONSTRUCTION SITE’

It remains unclear when the annual report will be released. The delay was unusual, according to five attorneys and experts Reuters spoke to .

“The disclosure is strategically and carefully worded so as not to raise alarms,” said Jacob Frenkel, a former SEC enforcement attorney who is now government investigations and securities enforcement practice chair for law firm Dickinson Wright.

It “lays the groundwork for the explanation for the revisions to the financial statements. Nothing about the release has an ‘enforcement’ centric tone.”

Still, the Credit Suisse announcement concerned analysts.

“(It) does not help investor sentiment and it does not help in rebuilding trust,” said Andreas Venditti from Vontobel.

Switzerland’s second-biggest bank has begun a major overhaul of its business, cutting costs and jobs to revive its fortunes, including creating a separate business for its investment bank under the CS First Boston brand.

Daniel Bosshard from Luzerner Kantonalbank described Credit Suisse as “a major construction site” and said “the share is only suitable for turnaround speculators.”

In February, Credit Suisse reported that 2022 brought its biggest annual loss since the 2008 global financial crisis after rattled clients pulled funds from the bank, and it warned that a further “substantial” loss would come this year.

Among a string of scandals, Credit Suisse was hard hit by the collapse of U.S. investment firm Archegos in 2021 as well as the freezing of billions of supply chain finance funds linked to insolvent British financier Greensill.

The bank was also rocked by a prosecution in Switzerland involving laundering money for a criminal gang.

Meanwhile, credit ratings agency Standard & Poor’s downgraded Credit Suisse to just one level above so-called junk status in November last year.