OPINION

Dear Friends,

Companies leaving Delaware has become so common now, that it has been given a nickname: Dexit, which means companies exiting Delaware. This is terrible for our state, folks. Awful for our reputation and our finances and our image across the USA!

Dexit is a phrase coined by Phil Shawe, CEO of TransPerfect, which was one of the first to leave Delaware due to what I saw as corrupt Chancery Court treatment by Andre Bouchard and Leo Strine, then followed by Chancellor Kathaleen McCormick.

Big company CEOs like Elon Musk and Phil Shawe have put this issue on the map. The media has followed my Coastal Network lead, writing about this more lately. Yet, few stories nail the reality of what’s going on better than the story below.

Folks, I’ve been writing about this for a decade: Delaware’s incorporation revenue has been devastated. There’s not a lot of money flowing into America’s First State. The Chancery Court has ruined the best thing Delaware had going for itself.

Delaware corporations are leaving in droves, no longer paying Delaware because they’ve moved or they’re moving their incorporation to another state.

See the complete story by Yahoo Finance Senior Legal Reporter Alexis Keenan below and send me your feedback. It is always welcome and appreciated.

Respectfully Yours,

JUDSON Bennett–Coastal Network

More Musk-like ‘Dexits’ pose fresh threat to Delaware’s corporation crown

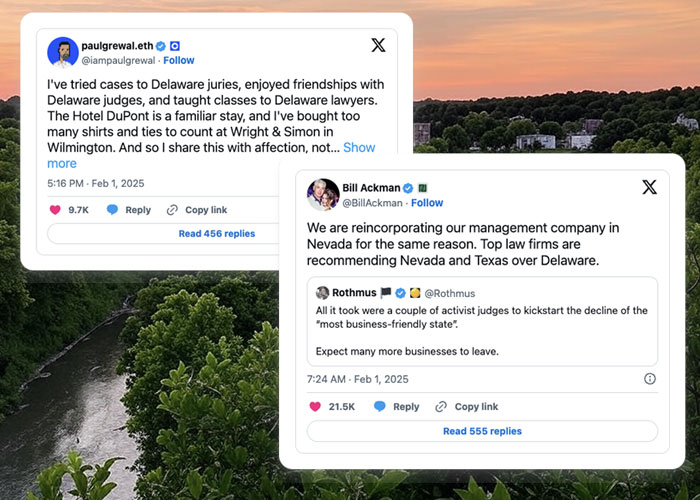

More CEOs fed up with Delaware and its powerful Chancery Court are going the way of Elon Musk, reincorporating their companies elsewhere and publicly airing their frustrations.

Over the past year, Meta (META), Dropbox (DBX), hedge fund Pershing Square Capital Management, Trade Desk (TTD), Fidelity National Financial (FNF), and Sonoma Pharmaceuticals (SNOA) have all floated plans to move their incorporations out of the “first state” — a nickname granted to Delaware because it was the first to ratify the US Constitution.

These so-called “Dexits” would follow Musk-led companies Tesla (TSLA), SpaceX, the Boring Company, Neuralink, and X that left or are trying to leave Delaware.

“Never incorporate your company in the state of Delaware,” Musk said on X in January 2024 after the Chancery Court’s head judge, Chancellor Kathaleen McCormick, struck down a 2018 Tesla shareholder vote approving his $56 billion performance-based compensation deal.

“I think there is a lot of pressure on Delaware,” said University of Virginia Law School professor Michal Barzuza. “And I think the more moving, the easier it becomes for others to move.”

Bill Ackman, Pershing Square’s CEO, went public with his decision on the social platform X, owned by Musk, saying he had chosen Nevada.

“Top law firms are recommending Nevada and Texas over Delaware,” Ackman wrote.

For roughly the past century, Delaware has been the dominant place to incorporate because of its so-called corporate-friendly laws, specialized business courts, and ease of filing company documents.

The state touts that it is home to more than two-thirds of all Fortune 500 companies. In 2023, Delaware hit a record 2 million total incorporations but saw a drop in the percentage of Fortune 500 companies registered there to 67.6% from 68.2% in 2022.

Delaware generated $1.33 billion in incorporation revenue in 2024, about 22% of the state’s total revenue.

Places like Nevada, Texas, South Dakota, North Carolina, Washington, and Wyoming that want some of this same revenue are trying to chip away at Delaware’s dominance with their own business-friendly strategies.

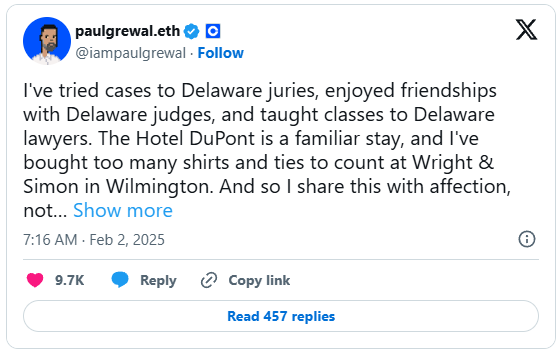

“Delaware is at serious risk of losing its standing as the leading state of incorporation for American companies,” Coinbase’s (COIN) chief legal officer Paul Grewal posted on X earlier this month.

Those recruiting efforts got a boost last year from the world’s richest man, Musk, when Tesla shareholders voted to incorporate in Texas instead of Delaware — a move made in reaction to the ruling against Musk’s pay.

But even that reincorporation is held up in the Chancery Court, in a separate case before the same judge who voided Musk’s compensation. The suit, filed by an investor who challenged the vote, alleged that the reincorporation was designed to shield Musk from Delaware law.

A similar reincorporation scuffle arose between Tripadvisor (TRIP) and two of its shareholders in 2023, before Musk’s attempted Dexits.

In Maffei v.

The conflict came to an end last week when Delaware’s Supreme Court overturned the Chancery Court’s vice chancellor, J.

The high court disagreed with Chancery that the more rigorous “entire fairness” standard should be applied and said the decision was subject to the more lenient “business judgment” rule.

‘They don’t feel like they are getting a fair hearing’

The recent high-profile departures from Delaware are attracting attention from the state’s newly elected governor, Matt Meyer, a business lawyer, who launched a working group to study mounting complaints directed at the court.

“I’m hearing something similar from a number of Delaware companies and attorneys,” Meyer said in an interview with CNBC. “That they feel like they get the same judge every time when they come to Delaware business court, and they don’t feel like they are getting a fair hearing.”

Delaware lawmakers who hope to keep more companies in their state on Monday proposed amending a bill that would limit investor lawsuits by allowing corporate boards to further insulate their directors, officers, and controlling shareholders from liability.

The legislation, SB 21, would provide boards with safe harbor protections for the decision-makers in transactions where their interests or relationships raise conflicts of interest. It would also add conditions for investors to inspect company records, making it more difficult for plaintiffs to find evidence supporting a lawsuit.

“This legislation restores Delaware law to what it was historically known for being: balanced as to the relevant stakeholders, protective of stockholder rights and interests, workable for corporate leaders, and empowering of directors who act in good faith with appropriate process and in accordance with their fiduciary duties,” Delaware’s Senate Majority Leader Bryan Townsend and his co-sponsors said in a statement.

An exterior view of the Delaware Legislative Hall, the state capitol building. (Photo by Kent Nishimura/Getty Images) ·Kent Nishimura via Getty Images

One executive who moved his company from the state, Phil Shawe, CEO and co-founder of the translation service company TransPerfect, is among those who have told the governor that he was treated unfairly by the court.

Shawe spent years there in litigation against his TransPerfect co-founder and co-director.

When the pair became deadlocked over the business’s direction, the court concluded the impasse posed “irreparable harm” to the company. To address the perceived harm, the judge appointed a custodian to run a court-ordered sale.

“They ran an auction and didn’t produce a higher price than what I had already offered [the co-founder] years earlier,” Shawe said, alleging the auction exceeded the court’s authority.

“How the judge came to this conclusion to do this is very suspect, because the business was always growing in revenue, and profit, so there was never a real imminent harm that required a judge to take control of the business.”

Shawe ultimately outbid his challengers and purchased his co-founder’s half of the company, though after spending millions on lawyers and court fees. He has since backed advocacy group Citizens for Judicial Fairness (formerly Citizens for a Pro-Business Delaware) to push the court for more transparency and equity.

“There is something wrong with that system,” Shawe said.

The Leonard L. Williams Justice Center houses the Court of Chancery in Wilmington, Del. (AP Photo/Matt Rourke) ·ASSOCIATED PRESS

Israeli technology investor Itzik On is another executive moving his companies out of the state and says he is frustrated with the Chancery Court.

“I’m very afraid of the Delaware system going against entrepreneurs. I think it’s a systematic risk against the entire corporate world and the entire startup world,” On said. “You start considering: Why should I invest in the US? Now it’s become risky.”

On, Movado’s sole director, claims the court allowed an investor and shareholder in his now-dissolved healthcare startup, Movado PT Technologies, who was also an executive at a competing healthcare company, to maintain a derivative claim against him.

The Movado shareholder claimed On did not fully inform shareholders about material issues, including executive compensation terms and conflicts of interest among executives.

“You can’t have a derivative complaint when a shareholder is a rival,” On said.

He also disagreed with the judge’s invalidation of two shareholder votes ratifying all board actions, including executive compensation, on grounds that the votes were the product of a “fiduciary breach.”

On calls himself a “small player” as an investment manager for 24 US startups. However, he argues that Chancery dealt him a fate similar to Musk’s when the court held there was a fiduciary breach despite two shareholder votes.

“The second you have this [fiduciary breach] tag, you’ve lost,” On said. “Now everyone is at risk for fiduciary breach.”

On and his sister are appealing their case to the Delaware Supreme Court. In the meantime, he said, “All our companies are exiting Delaware.”

Alexis Keenan is a legal reporter for Yahoo Finance. Follow Alexis on X @